Predator Drones Market Size, Trends and Insights By Type (Fixed Wing, Rotary Wing, Hybrid), By Range (Visual Line of Sight, Extended Visual Line of Sight, Beyond Line of Sight), By Technology (Remotely Operated, Semi-Autonomous, Autonomous), and By Region - Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Report Snapshot

| Study Period: | 2023-2032 |

| Fastest Growing Market: | Asia-Pacific |

| Largest Market: | Europe |

Major Players

- General Atomics Aeronautical Systems Inc.

- Boeing Company

- Northrop Grumman Corporation

- Lockheed Martin Corporation

- AeroVironment Inc.

- Others

Reports Description

As per the current market research conducted by CMI Team, the global Predator Drones Market is expected to record a CAGR of 10.8% from 2023 to 2032. In 2022, the market size is projected to reach a valuation of USD 13.4 billion. By 2032, the valuation is anticipated to reach USD 35.2 billion.

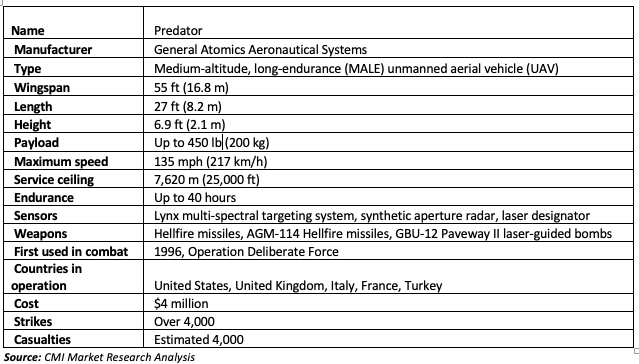

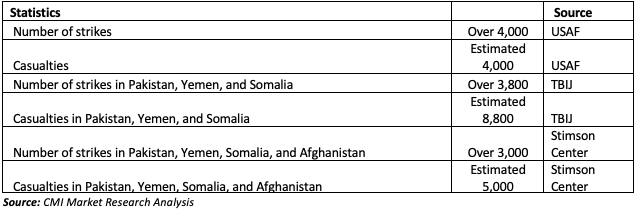

Predator Drone Statistics

The market for predator drones encompasses the production and deployment of unmanned aerial vehicles used for surveillance and reconnaissance purposes. Key trends driving this market include the demand for advanced capabilities, improved operational efficiency, and the growing utilization of unmanned systems in various sectors.

Advancements in communication systems, sensor technology, and data analysis contribute to the market’s growth. Competition among industry players remains intense as they strive to innovate and meet evolving customer needs in the dynamic predator drone landscape.

Predator Drones Market – Significant Growth Factors

The Predator Drones Market presents significant growth opportunities due to several factors:

- Integration of Artificial Intelligence and Machine Learning: The integration of artificial intelligence (AI) and machine learning (ML) technologies in predator drones is opening up new possibilities for autonomous operations, intelligent decision-making, and advanced data analysis. AI-powered features like object recognition, autonomous navigation, and predictive analytics enhance the capabilities of predator drones and create opportunities for improved mission effectiveness and operational efficiency.

- Advancements in Drone Technology: The continuous advancements in predator drone technology, including improved endurance, range, payload capacity, and autonomous capabilities, are driving the market growth. These technological enhancements enable drones to perform complex missions, operate in challenging environments, and deliver accurate and real-time data for decision-making.

- Expansion of Industrial Applications: Predator drones find applications beyond the military domain, such as in agriculture, infrastructure inspection, disaster management, and environmental monitoring. The versatility and cost-effectiveness of predator drones make them attractive for various industrial sectors, driving market growth and expanding opportunities.

- Government Investments and Defense Modernization Programs: Governments worldwide are investing in the modernization of their defense capabilities, including the acquisition of advanced unmanned systems like predator drones. Defense modernization programs and increased defense budgets create favourable market conditions and opportunities for drone manufacturers and suppliers.

- Technological Collaboration and Partnerships: Collaborations between drone manufacturers, technology companies, and defense organizations foster technological advancements and drive market growth. Partnerships enable the sharing of expertise, resources, and research, leading to the development of innovative predator drone solutions and the exploration of new market opportunities.

Predator Drones Market – Mergers and Acquisitions

The Predator Drones Market has seen several mergers and acquisitions in recent years, with companies seeking to expand their market presence and leverage synergies to improve their product offerings and profitability. Some notable examples of mergers and acquisitions in the Predator Drones Market include:

- Textron Systems and Shield AI: In 2020, Textron Systems Corporation acquired Shield AI, a prominent provider of artificial intelligence (AI) software for autonomous systems. This acquisition enabled Textron Systems to enhance their unmanned aircraft systems, including predator drones, by integrating advanced AI technologies into their solutions.

- Kratos Defense and Unmanned Systems Division of Cerberus Capital Management: In 2018, Kratos Defense & Security Solutions, Inc. acquired the Unmanned Systems Division of Cerberus Capital Management. This acquisition expanded Kratos’ range of high-performance, jet-powered unmanned aerial systems, including predator drones, allowing them to offer a wider array of solutions to their clients.

- Lockheed Martin and AeroVironment: In 2019, Lockheed Martin Corporation and AeroVironment, Inc. joined forces to create integrated intelligence, surveillance, and reconnaissance (ISR) solutions for unmanned aircraft systems. By leveraging Lockheed Martin’s defense technologies and AeroVironment’s small, unmanned aircraft systems capabilities, including predator drones, this partnership aimed to enhance ISR capabilities and cater to the evolving needs of customers.

- Elbit Systems and Universal Avionics Systems Corporation: In 2021, Elbit Systems Ltd. acquired Universal Avionics Systems Corporation, a renowned provider of avionics systems for both manned and unmanned aircraft. This acquisition bolstered Elbit Systems’ position in the unmanned aircraft market, particularly with their predator drones, by integrating advanced avionics solutions into their offerings and enhancing their overall capabilities.

These mergers and acquisitions have helped companies expand their product offerings, improve their market presence, and capitalize on growth opportunities in the Predator Drones Market. The trend is expected to continue as companies seek to gain a competitive edge in the market.

COMPARATIVE ANALYSIS OF THE RELATED MARKET

| Predator Drones Market | Fighter Jet Engine Market | Military Training Aircraft Market |

| CAGR 10.8% (Approx) | CAGR 5.7% (Approx) | CAGR 3.28%

(Approx) |

| USD 35.2 billion by 2032 | USD 16.5 Billion by 2032 | USD 7.4 Billion by 2030 |

Predator Drones Market – Significant Threats

The Predator Drones Market faces several significant threats that could impact its growth and profitability in the future. Some of these threats include:

- Cybersecurity Risks: As predator drones increasingly rely on advanced technologies and connectivity, they become susceptible to cyber threats. Potential risks include unauthorized access, data breaches, and hacking attempts, which can compromise the confidentiality, integrity, and availability of critical information and drone operations.

- Regulatory Challenges: The operation of predator drones is subject to strict regulations imposed by aviation authorities and governments. Compliance with these regulations, such as airspace restrictions and privacy laws, can pose challenges for drone operators and limit their operational capabilities.

- Technological Advancements by Adversaries: Adversarial nations and organizations constantly strive to develop countermeasures to disrupt or disable predator drones. These may include anti-drone technologies, electronic warfare systems, or advanced detection and tracking mechanisms that can undermine the effectiveness of drone missions.

- Public Perception and Privacy Concerns: The use of predator drones in military and surveillance applications can raise concerns about privacy invasion and public perception. The potential misuse or accidental incidents involving drones can lead to negative public sentiment and stricter regulations, impacting the market growth and acceptance of predator drones.

Report Scope

| Feature of the Report | Details |

| Market Size in 2023 | USD 15.58 Billion |

| Projected Market Size in 2032 | USD 35.2 Billion |

| Market Size in 2022 | USD 13.4 Billion |

| CAGR Growth Rate | 10.8% CAGR |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Key Segment | By Type, Range, Technology and Region |

| Report Coverage | Revenue Estimation and Forecast, Company Profile, Competitive Landscape, Growth Factors and Recent Trends |

| Regional Scope | North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America |

| Buying Options | Request tailored purchasing options to fulfil your requirements for research. |

Category-Wise Insights

By Type:

- Fixed-wing drones: In the Predator Drones Market unmanned aerial vehicles with a rigid wing structure like traditional airplanes. These drones offer long flight times, and high speeds, and can carry heavier payloads, making them ideal for surveillance, reconnaissance, and long-distance missions. They efficiently cover large areas and capture detailed images or data for military, commercial, and civil purposes.

- Rotary-wing drones: Also known as rotorcraft or multirotor drones, create lift and propulsion by revolving blades. These drones excel at vertical take-off and landing, as well as hovering, allowing them to manoeuvre in tight places while remaining stable. They are commonly employed for close-range operations, aerial photography, videography, inspections, and rescue operations, providing mobility and agility in a variety of conditions.

- Hybrid Drones: It combine the advantages of fixed-wing and rotary-wing designs, providing vertical take-off and landing capabilities along with efficient forward flight. These drones can switch between hover and fixed-wing flight modes. By merging the benefits of both types, hybrid drones offer versatility, extended range, and increased payload capacity. They find applications in mapping, surveying, delivery, and surveillance tasks.

By Range:

- Visual Line of Sight (VLOS): Refers to operating a predator drone within the operator’s direct line of sight. This range limitation ensures visual monitoring and control of the drone, typically up to a few kilometres. Trends in the Predator Drones Market include advancements in obstacle avoidance systems and enhanced video transmission technologies to improve VLOS capabilities.

- Extended Visual Line of Sight (EVLOS): Allows predator drones to be operated beyond the operator’s direct line of sight but within a predefined distance. EVLOS relies on advanced communication systems, such as data links and ground-based observers, to maintain situational awareness. Trends involve the development of reliable and secure communication networks and the integration of artificial intelligence for automated monitoring during EVLOS operations.

- Beyond Line of Sight (BLOS): Enables predator drones to be operated remotely without the need for direct visual contact with the operator. BLOS relies on satellite communications or long-range data links for control and data transmission. Trends in the market focus on improving satellite communication capabilities, enhancing data encryption, and developing robust command and control systems for safe and effective BLOS operations.

By Technology:

- Remotely Operated: Remotely operated predator drones are controlled by human operators from a ground station, providing real-time control over the drone’s movements, sensors, and payload. The market trends for remotely operated drones focus on enhancing communication and control systems, optimizing operator interfaces, and integrating advanced features like video analytics and situational awareness tools.

- Semi-autonomous: Semi-autonomous predator drones combine human control with automated features, such as waypoint navigation and predefined mission parameters. Market trends for semi-autonomous drones include the development of intelligent flight control systems, advanced algorithms for mission planning and execution, and the integration of artificial intelligence (AI) and machine learning (ML) capabilities for improved decision-making.

- Autonomous: Autonomous predator drones operate without direct human intervention, utilizing onboard systems to perform various functions, including takeoff, navigation, and landing. In the market, trends for autonomous drones revolve around advancements in sensor technologies, AI-based autonomous flight control, obstacle detection and avoidance systems, and the ability to adapt to dynamic environments for effective and safe operations.

Predator Drones Market – Regional Analysis

The Predator Drones Market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

- North America: In North America, the trend in the Predator Drones Market revolves around technological advancements and innovation. Key trends include the development of advanced sensors and payloads, integration of artificial intelligence (AI) and machine learning (ML) capabilities, and the use of big data analytics for enhanced intelligence, surveillance, and reconnaissance (ISR) capabilities. General Atomics Aeronautical Systems, Inc. (GA-ASI) is a dominant manufacturer in the region, known for its Predator series of drones and continuous efforts in research and development.

- Europe: In Europe, the trend in the Predator Drones Market focuses on regulatory frameworks and the integration of drones into existing airspace. Emphasis is placed on ensuring safety, privacy, and compliance with regulations. Trends include the development of detect-and-avoid systems, a collaboration between drone manufacturers and aviation authorities, and the use of drones for commercial applications such as infrastructure inspection and emergency services. Airbus Defence and Space, with its range of unmanned systems including the Euro Hawk and Harfang, is a key player in the European market.

- Asia-Pacific: The Asia-Pacific region witnesses a growing demand for Predator Drones Market driven by increasing defense budgets, territorial disputes, and the need for advanced surveillance capabilities. The trend in the region includes the development of indigenous drone technologies, including sophisticated sensors, communication systems, and long-endurance capabilities. Key players dominating the market in this region include China Aerospace Science and Technology Corporation (CASC) and DJI, known for their innovative drone technologies and significant market presence.

- LAMEA: In the LAMEA (Latin America, Middle East, and Africa) region, the trend in the Predator Drones Market centers around security and defense applications. The market is driven by regional security challenges and the need for advanced ISR capabilities. Trends include the deployment of drones for border surveillance, counter-terrorism operations, and disaster management. Israel Aerospace Industries (IAI) is a dominant manufacturer in the LAMEA region, renowned for its expertise in unmanned systems, including the Heron and Eitan drones.

Competitive Landscape – Predator Drones Market

The Predator Drones Market is highly competitive, with a large number of manufacturers and retailers operating globally. Some of the key players in the market include:

- General Atomics Aeronautical Systems Inc.

- Boeing Company

- Northrop Grumman Corporation

- Lockheed Martin Corporation

- AeroVironment Inc.

- Textron Inc.

- Elbit Systems Ltd.

- Thales Group

- Israel Aerospace Industries Ltd.

- Saab AB

- Others

These companies operate in the market through various strategies such as product innovation, mergers and acquisitions, and partnerships. For example, In 2022, General Atomics Aeronautical Systems, Inc. (GA-ASI) announced a partnership with Kratos Defense & Security Solutions, Inc. to collaborate on the development and integration of advanced artificial intelligence (AI) capabilities into their Predator drone systems. This partnership aims to enhance autonomous capabilities and operational effectiveness in unmanned aerial systems.

The Predator Drones Market has seen the entry of several new players who have embraced innovation and development to establish themselves in the industry. Companies like AeroVironment, Textron Systems, and Shield AI have introduced cutting-edge drone technologies and incorporated advanced features like artificial intelligence.

However, the market is primarily dominated by key players who have a strong presence and extensive product offerings. General Atomics Aeronautical Systems, Inc. (GA-ASI) stands out as a prominent player, renowned for its Predator drone series and continuous advancements in unmanned aerial systems.

Other major players include Boeing, Lockheed Martin, and Israel Aerospace Industries (IAI), known for their expertise, technological progress, and strong partnerships with defense organizations. These dominant players maintain their market leadership through ongoing research and development, strategic collaborations, and a broad customer base that spans both military and commercial sectors.

The Predator Drones Market is segmented as follows:

By Type

- Fixed Wing

- Rotary Wing

- Hybrid

By Range

- Visual Line of Sight

- Extended Visual Line of Sight

- Beyond Line of Sight

By Technology

- Remotely Operated

- Semi-Autonomous

- Autonomous

By Region

North America

- U.S.

- Canada

- Mexico

- Rest of North America

Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- New Zealand

- Australia

- South Korea

- Rest of Asia Pacific

The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America

Table of Contents

- Chapter 1. Preface

- 1.1 Report Description and Scope

- 1.2 Research scope

- 1.3 Research methodology

- 1.3.1 Market Research Type

- 1.3.2 Market research methodology

- Chapter 2. Executive Summary

- 2.1 Global Predator Drones Market, (2024 – 2033) (USD Billion)

- 2.2 Global Predator Drones Market : snapshot

- Chapter 3. Global Predator Drones Market – Industry Analysis

- 3.1 Predator Drones Market: Market Dynamics

- 3.2 Market Drivers

- 3.2.1 Integration of Artificial Intelligence and Machine Learning

- 3.2.2 Advancements in Drone Technology

- 3.2.3 Expansion of Industrial Applications

- 3.2.4 Government Investments and Defense Modernization Programs

- 3.2.5 Technological Collaboration and Partnerships.

- 3.3 Market Restraints

- 3.4 Market Opportunities

- 3.5 Market Challenges

- 3.6 Porters Five Forces Analysis

- 3.7 Market Attractiveness Analysis

- 3.7.1 Market attractiveness analysis By Type

- 3.7.2 Market attractiveness analysis By Range

- 3.7.3 Market attractiveness analysis By Technology

- Chapter 4. Global Predator Drones Market- Competitive Landscape

- 4.1 Company market share analysis

- 4.1.1 Global Predator Drones Market: company market share, 2022

- 4.2 Strategic development

- 4.2.1 Acquisitions & mergers

- 4.2.2 New Product launches

- 4.2.3 Agreements, partnerships, cullaborations, and joint ventures

- 4.2.4 Research and development and Regional expansion

- 4.3 Price trend analysis

- 4.1 Company market share analysis

- Chapter 5. Global Predator Drones Market – Type Analysis

- 5.1 Global Predator Drones Market overview: By Type

- 5.1.1 Global Predator Drones Market share, By Type, 2022 and – 2033

- 5.2 Fixed Wing

- 5.2.1 Global Predator Drones Market by Fixed Wing, 2024 – 2033 (USD Billion)

- 5.3 Rotary Wing

- 5.3.1 Global Predator Drones Market by Rotary Wing, 2024 – 2033 (USD Billion)

- 5.4 Hybrid

- 5.4.1 Global Predator Drones Market by Hybrid , 2024 – 2033 (USD Billion)

- 5.1 Global Predator Drones Market overview: By Type

- Chapter 6. Global Predator Drones Market – Range Analysis

- 6.1 Global Predator Drones Market overview: By Range

- 6.1.1 Global Predator Drones Market share, By Range, 2022 and – 2033

- 6.2 Visual Line of Sight

- 6.2.1 Global Predator Drones Market by Visual Line of Sight, 2024 – 2033 (USD Billion)

- 6.3 Extended Visual Line of Sight

- 6.3.1 Global Predator Drones Market by Extended Visual Line of Sight, 2024 – 2033 (USD Billion)

- 6.4 Beyond Line of Sight

- 6.4.1 Global Predator Drones Market by Beyond Line of Sight, 2024 – 2033 (USD Billion)

- 6.1 Global Predator Drones Market overview: By Range

- Chapter 7. Global Predator Drones Market – Technology Analysis

- 7.1 Global Predator Drones Market overview: By Technology

- 7.1.1 Global Predator Drones Market share, By Technology, 2022 and – 2033

- 7.2 Remotely Operated

- 7.2.1 Global Predator Drones Market by Remotely Operated, 2024 – 2033 (USD Billion)

- 7.3 Semi-Autonomous

- 7.3.1 Global Predator Drones Market by Semi-Autonomous, 2024 – 2033 (USD Billion)

- 7.4 Autonomous

- 7.4.1 Global Predator Drones Market by Autonomous, 2024 – 2033 (USD Billion)

- 7.1 Global Predator Drones Market overview: By Technology

- Chapter 8. Predator Drones Market – Regional Analysis

- 8.1 Global Predator Drones Market Regional Overview

- 8.2 Global Predator Drones Market Share, by Region, 2022 & – 2033 (USD Billion)

- 8.3. North America

- 8.3.1 North America Predator Drones Market, 2024 – 2033 (USD Billion)

- 8.3.1.1 North America Predator Drones Market, by Country, 2024 – 2033 (USD Billion)

- 8.3.1 North America Predator Drones Market, 2024 – 2033 (USD Billion)

- 8.4 North America Predator Drones Market, by Type, 2024 – 2033

- 8.4.1 North America Predator Drones Market, by Type, 2024 – 2033 (USD Billion)

- 8.5 North America Predator Drones Market, by Range, 2024 – 2033

- 8.5.1 North America Predator Drones Market, by Range, 2024 – 2033 (USD Billion)

- 8.6 North America Predator Drones Market, by Technology, 2024 – 2033

- 8.6.1 North America Predator Drones Market, by Technology, 2024 – 2033 (USD Billion)

- 8.7. Europe

- 8.7.1 Europe Predator Drones Market, 2024 – 2033 (USD Billion)

- 8.7.1.1 Europe Predator Drones Market, by Country, 2024 – 2033 (USD Billion)

- 8.7.1 Europe Predator Drones Market, 2024 – 2033 (USD Billion)

- 8.8 Europe Predator Drones Market, by Type, 2024 – 2033

- 8.8.1 Europe Predator Drones Market, by Type, 2024 – 2033 (USD Billion)

- 8.9 Europe Predator Drones Market, by Range, 2024 – 2033

- 8.9.1 Europe Predator Drones Market, by Range, 2024 – 2033 (USD Billion)

- 8.10 Europe Predator Drones Market, by Technology, 2024 – 2033

- 8.10.1 Europe Predator Drones Market, by Technology, 2024 – 2033 (USD Billion)

- 8.11. Asia Pacific

- 8.11.1 Asia Pacific Predator Drones Market, 2024 – 2033 (USD Billion)

- 8.11.1.1 Asia Pacific Predator Drones Market, by Country, 2024 – 2033 (USD Billion)

- 8.11.1 Asia Pacific Predator Drones Market, 2024 – 2033 (USD Billion)

- 8.12 Asia Pacific Predator Drones Market, by Type, 2024 – 2033

- 8.12.1 Asia Pacific Predator Drones Market, by Type, 2024 – 2033 (USD Billion)

- 8.13 Asia Pacific Predator Drones Market, by Range, 2024 – 2033

- 8.13.1 Asia Pacific Predator Drones Market, by Range, 2024 – 2033 (USD Billion)

- 8.14 Asia Pacific Predator Drones Market, by Technology, 2024 – 2033

- 8.14.1 Asia Pacific Predator Drones Market, by Technology, 2024 – 2033 (USD Billion)

- 8.15. Latin America

- 8.15.1 Latin America Predator Drones Market, 2024 – 2033 (USD Billion)

- 8.15.1.1 Latin America Predator Drones Market, by Country, 2024 – 2033 (USD Billion)

- 8.15.1 Latin America Predator Drones Market, 2024 – 2033 (USD Billion)

- 8.16 Latin America Predator Drones Market, by Type, 2024 – 2033

- 8.16.1 Latin America Predator Drones Market, by Type, 2024 – 2033 (USD Billion)

- 8.17 Latin America Predator Drones Market, by Range, 2024 – 2033

- 8.17.1 Latin America Predator Drones Market, by Range, 2024 – 2033 (USD Billion)

- 8.18 Latin America Predator Drones Market, by Technology, 2024 – 2033

- 8.18.1 Latin America Predator Drones Market, by Technology, 2024 – 2033 (USD Billion)

- 8.19. The Middle-East and Africa

- 8.19.1 The Middle-East and Africa Predator Drones Market, 2024 – 2033 (USD Billion)

- 8.19.1.1 The Middle-East and Africa Predator Drones Market, by Country, 2024 – 2033 (USD Billion)

- 8.19.1 The Middle-East and Africa Predator Drones Market, 2024 – 2033 (USD Billion)

- 8.20 The Middle-East and Africa Predator Drones Market, by Type, 2024 – 2033

- 8.20.1 The Middle-East and Africa Predator Drones Market, by Type, 2024 – 2033 (USD Billion)

- 8.21 The Middle-East and Africa Predator Drones Market, by Range, 2024 – 2033

- 8.21.1 The Middle-East and Africa Predator Drones Market, by Range, 2024 – 2033 (USD Billion)

- 8.22 The Middle-East and Africa Predator Drones Market, by Technology, 2024 – 2033

- 8.22.1 The Middle-East and Africa Predator Drones Market, by Technology, 2024 – 2033 (USD Billion)

- Chapter 9. Company Profiles

- 9.1 General Atomics Aeronautical Systems Inc.

- 9.1.1 Overview

- 9.1.2 Financials

- 9.1.3 Product Portfolio

- 9.1.4 Business Strategy

- 9.1.5 Recent Developments

- 9.2 Boeing Company

- 9.2.1 Overview

- 9.2.2 Financials

- 9.2.3 Product Portfolio

- 9.2.4 Business Strategy

- 9.2.5 Recent Developments

- 9.3 Northrop Grumman Corporation

- 9.3.1 Overview

- 9.3.2 Financials

- 9.3.3 Product Portfolio

- 9.3.4 Business Strategy

- 9.3.5 Recent Developments

- 9.4 Lockheed Martin Corporation

- 9.4.1 Overview

- 9.4.2 Financials

- 9.4.3 Product Portfolio

- 9.4.4 Business Strategy

- 9.4.5 Recent Developments

- 9.5 AeroVironment Inc.

- 9.5.1 Overview

- 9.5.2 Financials

- 9.5.3 Product Portfolio

- 9.5.4 Business Strategy

- 9.5.5 Recent Developments

- 9.6 Textron Inc.

- 9.6.1 Overview

- 9.6.2 Financials

- 9.6.3 Product Portfolio

- 9.6.4 Business Strategy

- 9.6.5 Recent Developments

- 9.7 Elbit Systems Ltd.

- 9.7.1 Overview

- 9.7.2 Financials

- 9.7.3 Product Portfolio

- 9.7.4 Business Strategy

- 9.7.5 Recent Developments

- 9.8 Thales Group

- 9.8.1 Overview

- 9.8.2 Financials

- 9.8.3 Product Portfolio

- 9.8.4 Business Strategy

- 9.8.5 Recent Developments

- 9.9 Israel Aerospace Industries Ltd.

- 9.9.1 Overview

- 9.9.2 Financials

- 9.9.3 Product Portfolio

- 9.9.4 Business Strategy

- 9.9.5 Recent Developments

- 9.10 Saab AB

- 9.10.1 Overview

- 9.10.2 Financials

- 9.10.3 Product Portfolio

- 9.10.4 Business Strategy

- 9.10.5 Recent Developments

- 9.11 Others.

- 9.11.1 Overview

- 9.11.2 Financials

- 9.11.3 Product Portfolio

- 9.11.4 Business Strategy

- 9.11.5 Recent Developments

- 9.1 General Atomics Aeronautical Systems Inc.

List Of Figures

Figures No 1 to 25

List Of Tables

Tables No 1 to 77

Report Methodology

In order to get the most precise estimates and forecasts possible, Custom Market Insights applies a detailed and adaptive research methodology centered on reducing deviations. For segregating and assessing quantitative aspects of the market, the company uses a combination of top-down and bottom-up approaches. Furthermore, data triangulation, which examines the market from three different aspects, is a recurring theme in all of our research reports. The following are critical components of the methodology used in all of our studies:

Preliminary Data Mining

On a broad scale, raw market information is retrieved and compiled. Data is constantly screened to make sure that only substantiated and verified sources are taken into account. Furthermore, data is mined from a plethora of reports in our archive and also a number of reputed & reliable paid databases. To gain a detailed understanding of the business, it is necessary to know the entire product life cycle and to facilitate this, we gather data from different suppliers, distributors, and buyers.

Surveys, technological conferences, and trade magazines are used to identify technical issues and trends. Technical data is also gathered from the standpoint of intellectual property, with a focus on freedom of movement and white space. The dynamics of the industry in terms of drivers, restraints, and valuation trends are also gathered. As a result, the content created contains a diverse range of original data, which is then cross-validated and verified with published sources.

Statistical Model

Simulation models are used to generate our business estimates and forecasts. For each study, a one-of-a-kind model is created. Data gathered for market dynamics, the digital landscape, development services, and valuation patterns are fed into the prototype and analyzed concurrently. These factors are compared, and their effect over the projected timeline is quantified using correlation, regression, and statistical modeling. Market forecasting is accomplished through the use of a combination of economic techniques, technical analysis, industry experience, and domain knowledge.

Short-term forecasting is typically done with econometric models, while long-term forecasting is done with technological market models. These are based on a synthesis of the technological environment, legal frameworks, economic outlook, and business regulations. Bottom-up market evaluation is favored, with crucial regional markets reviewed as distinct entities and data integration to acquire worldwide estimates. This is essential for gaining a thorough knowledge of the industry and ensuring that errors are kept to a minimum.

Some of the variables taken into account for forecasting are as follows:

• Industry drivers and constraints, as well as their current and projected impact

• The raw material case, as well as supply-versus-price trends

• Current volume and projected volume growth through 2030

We allocate weights to these variables and use weighted average analysis to determine the estimated market growth rate.

Primary Validation

This is the final step in our report’s estimating and forecasting process. Extensive primary interviews are carried out, both in-person and over the phone, to validate our findings and the assumptions that led to them.

Leading companies from across the supply chain, including suppliers, technology companies, subject matter experts, and buyers, use techniques like interviewing to ensure a comprehensive and non-biased overview of the business. These interviews are conducted all over the world, with the help of local staff and translators, to overcome language barriers.

Primary interviews not only aid with data validation, but also offer additional important insight into the industry, existing business scenario, and future projections, thereby improving the quality of our reports.

All of our estimates and forecasts are validated through extensive research work with key industry participants (KIPs), which typically include:

• Market leaders

• Suppliers of raw materials

• Suppliers of raw materials

• Buyers.

The following are the primary research objectives:

• To ensure the accuracy and acceptability of our data.

• Gaining an understanding of the current market and future projections.

Data Collection Matrix

| Perspective | Primary research | Secondary research |

| Supply-side |

|

|

| Demand-side |

|

|

Market Analysis Matrix

| Qualitative analysis | Quantitative analysis |

|

|

Prominent Player

- General Atomics Aeronautical Systems Inc.

- Boeing Company

- Northrop Grumman Corporation

- Lockheed Martin Corporation

- AeroVironment Inc.

- Textron Inc.

- Elbit Systems Ltd.

- Thales Group

- Israel Aerospace Industries Ltd.

- Saab AB

- Others

FAQs

“North America” region will lead the Global Predator Drones Market during the forecast period 2023 to 2032.

The key factors driving the Market are Integration of Artificial Intelligence and Machine Learning, Advancements in Drone Technology, Expansion of Industrial Applications, Government Investments and Defense Modernization Programs And Technological Collaboration and Partnerships.

The key players operating in the Predator Drones Market are General Atomics Aeronautical Systems Inc., Boeing Company, Northrop Grumman Corporation, Lockheed Martin Corporation, AeroVironment Inc., Textron Inc., Elbit Systems Ltd., Thales Group, Israel Aerospace Industries Ltd., Saab AB, Others.

The Global Predator Drones Market is expanding growth with a CAGR of approximately 10.8% during the forecast period (2023 to 2032).

The Global Predator Drones Market size was valued at USD 13.4 Billion in 2022 and it is projected to reach around USD 35.2 Billion by 2032.